Indian Customs EDI System

The Indian Customs EDI Systems (ICES), a flagship application of NIC, was launched in the year 1995. It is the outcome of a systems study conducted by National Informatics Centre and Central Board of Indirect Taxes and Customs in 1992 at number of Customs Houses throughout the country. The key element of the application is connecting all the players involved in international trade with the Customs House electronically.

The core functionality of the Indian Customs procedures has been fully automated through ICES. Large number of documents that trade, transport and regulatory agencies (collectively called Trading Partners) are required to submit/ receive in the process of live customs clearance are now being processed online. It is now operational at 254 major customs locations handling nearly 99% of India’s International trade in terms of import and export consignments.

Customs Export Facilitation – NIC as Technology Partner

- New Modular Facilities

- Introduction of GST cess for clear accounting heads

- Facilitation of DGFT to release ROSL license

- Introduction of new module – Fail after success case bank credit of GST refund

- Facility to view foreign exchange realization to customs official

- Streamlining of alert modules by introduction of new role exp alert

- New module for road transshipment of cargo from air sites

- Number of facilitations to exporters during this tough time

- Increase validity of Export Document (SB) to 30 days – To handle slow movement of cargo

- Automatic release of withheld GST refund – To handle cash crunch

- Increase in number of documents in scroll from 2000-5000 – For fast payment of refunds

- Single window

- Email/SMS information to Exporter for their incentives/queries etc.

- Paradigm shift from document clearance to Cargo movement

- Implementation of messages

- E-seal (Exporter – Customs – Exporter)

- Custodian (Custodian – Customs – Custodian)

- Transhipper (Transhipper – Customs – Transhipper)

- CSN (Shipping line – Customs – Shipping line)

- Environment-friendly measurement

- e-LEO SB copy

- e-Gate pass challan

- Utilities for preparing e-docs for SCTMR – custodian, transhipper, shipping line etc.

- Online bank account registration

ICES has two aspects

- Internal Automation of the Custom House for a comprehensive, paperless, fully automated customs clearance system that makes the functioning of Customs clearance transparent and efficient.

- Online, real-time electronic interface with the trade, transport, banks, and regulatory agencies concerned with customs clearance of import and export cargo through ICEGATE.

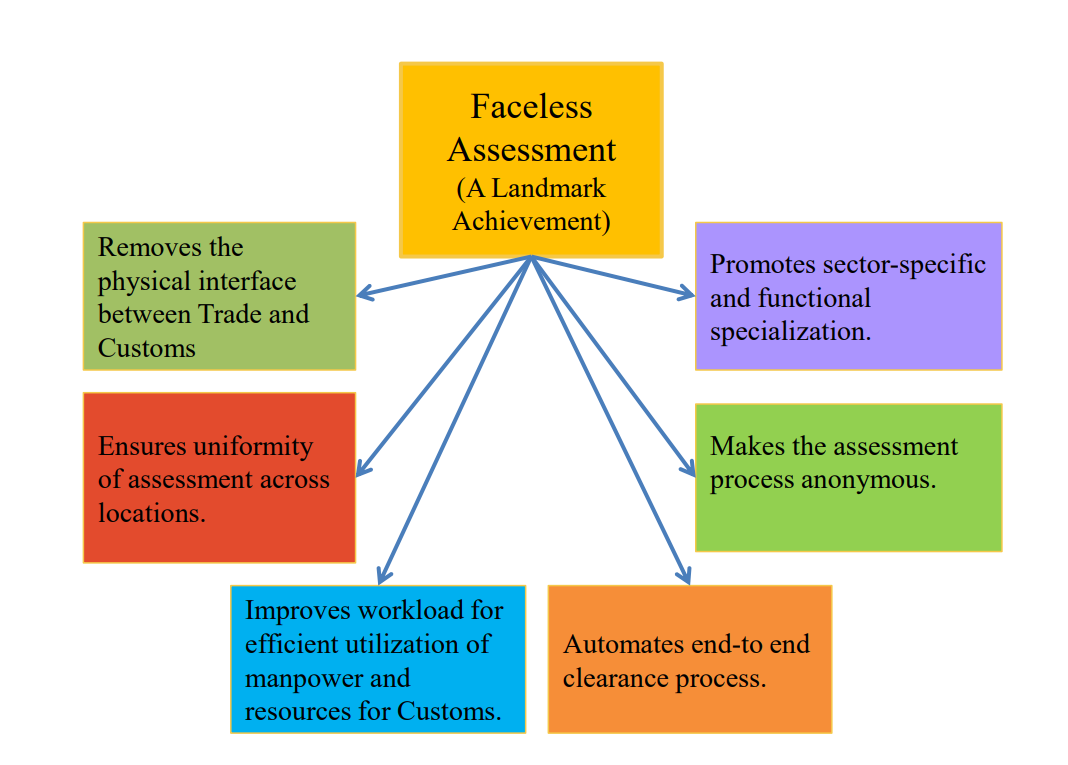

To meet the objective of proving a more efficient, transparent, and standardized Customs assessment experience, “Faceless Customs” has been implemented. This revolutionary step has covered that extra mile in reducing Trade and Customs physical interaction as the document assessment process has gone truly national. The Exporter/Importer are transparent to the fact as to where the documents are being assessed.

- Faceless Assessment (A Landmark Achievement)

- Removes the physical interface between Trade and Customs

- Promotes sector- specific and functional specialization

- Ensures uniformity of assessment across locations

- Makes the assessment process anonymous

- Improves workload for efficient utilization of manpower and resources for Customs

- Automates end-to-end clearance process

Major Components of Indian Custom automation

- ICEGATE is the interface of ICES with the external world for customs clearance related messages and sharing of trade Statistics/Customs clearance data with licensing and regulatory agencies such as DGFT, DGCI&S, Ministry of Steel, RBI etc.

- ICES automatically receive and process all incoming messages. ICES generate all outgoing messages automatically at the appropriate stage of the clearance process.

- Single Window Interface for facilitating trade (SWIFT) – ICES allow importers and exporters, the facility to lodge their clearance documents online at a single point only. Required permissions, if any, from other regulatory agencies is obtained online without the trader having to approach these agencies. The Single Window Interface for Trade (SWIFT) has reduced interface with Governmental agencies, dwell time and the cost of doing business.

- E-Sanchit to facilitate trade paperless processing of documents has been introduced. The idea is to reduce physical interface between customs regulatory agencies and the trade and to increase the speed of clearance.

Remote EDI System (RES) is windows-based series of packages which facilitates the Custom House Agents/ Importers/ Exporters in preparation of Bill of Entry, Shipping Bill, Import Report, Export Report, Consol Manifest declarations in the format acceptable to ICES for remote submission at Customs House through Indian Customs EDI Gateway (ICEGATE). The Exporters, Importers and Custom House Agents (CHAs) can submit all related documents through the Remote EDI Software (RES), which is a standalone software package developed by NIC.

Benefits

- Fully Automated Operations

- 24*7 declarations acceptance

- Time Saving

- Data Accuracy

- Cost Effectiveness

- Improved Security and Risk Management

- Quicker cargo releases resulting in more efficient deliveries

For details, please visit: https://ices.nic.in/